Running a successful business is a challenging task. It requires hard work, dedication, and creativity to make a business flourish and stand the test of time. Businesses come in all shapes and sizes and operate on different scales. Whether running a small business from a home office or a large corporation with multiple locations, protecting your business and its assets is essential. That’s where business insurance comes in.

Types of Business Insurance for Employees: What It Means

Business insurance is a type of insurance that protects businesses from potential losses or damages resulting from a variety of risks. Business insurance policies for employees are designed to cover the costs associated with events related to life, health, accident, critical illness among employees and more.

There are many types of business insurance for employees tailored to meet the specific needs of different kinds of businesses in Dallas Fort Worth area. The types of coverage included in a policy can vary greatly depending on the industry and the size of the company.

Business insurance helps to protect businesses from financial losses resulting from unexpected events. By providing coverage for these risks, business insurance can reduce the financial burden on companies and ultimately help them to remain profitable.

What are the Common Types of Business Insurance for Employees in Dallas-Fort Worth area?

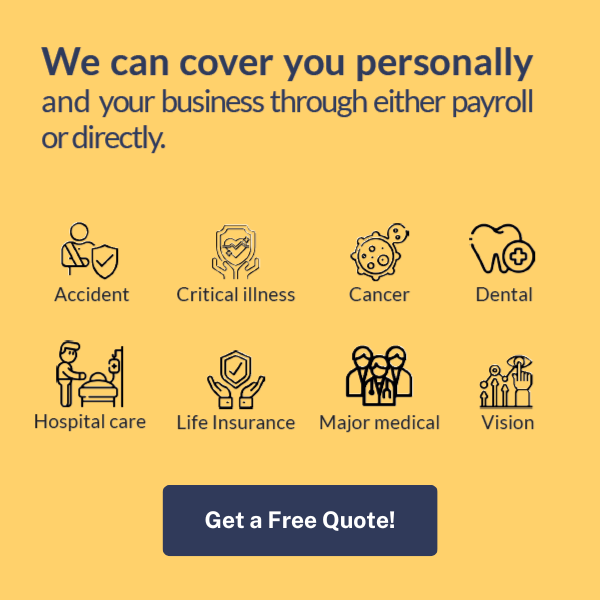

Business insurance comes in many forms, each of which protects against different risks. The common types of business insurance for employees include:

- Major Medical Insurance

- Dental Insurance

- Vision Insurance

- Life Insurance

- Accident Insurance

- Critical Illness Insurance

- Telehealth Insurance

6 Business Insurance Every Business Owner Must Have for Their Employees DFW Texas

1. Major Medical Insurance

Major medical insurance is a type of health insurance that covers the cost of medical treatments and procedures for severe illnesses and injuries. This insurance can cover hospital stays, surgeries, prescription medications, and other treatments.

As a business owner, providing major medical insurance to your employees can help attract and retain top talent and help employees feel more financially secure and protected in the event of a severe medical issue.

2. Dental Insurance

Dental insurance is a type of insurance that covers the cost of dental treatments and procedures, including routine check-ups, cleanings, fillings, and major dental work such as root canals or crowns.

Offering dental insurance to your employees can help promote good oral health, which is essential for overall health and well-being. It can also help attract and retain employees who value comprehensive health coverage.

3. Life Insurance

Life insurance is another essential type of insurance which offers financial security to beneficiaries of the insured person in the event of the policyholder’s death. For businesses, providing life insurance to employees can help ensure that their families are cared for in the event of an unexpected death. It can also help employees feel more financially secure and valued by their employers.

4. Critical Illness Insurance

Critical illness insurance is a type of insurance that provides a lump sum payment to the policyholder in the event of a severe illness such as cancer, heart attack, or stroke. This insurance can help cover the costs of medical treatments and living expenses during recovery. As a business owner, providing critical illness insurance to your employees can help them feel more financially secure and protected in the event of a severe illness.

5. Vision Insurance

Vision insurance is a type of insurance that covers the cost of vision-related treatments and procedures, including eye exams, glasses, and contact lenses.

Providing vision insurance to your employees promotes good eye health and vision, which are essential for their well-being in the long term. It can also help attract and retain employees who value comprehensive health coverage.

6. Telehealth Insurance

Telehealth insurance is a relatively new type of insurance that covers the cost of virtual medical consultations and treatments. This type of insurance can benefit businesses with remote or distributed workforces, allowing employees to access medical care from anywhere.

Offering telehealth insurance to your employees can also help reduce absenteeism and increase productivity, as employees can receive medical care without taking time off work.

Importance for Business Owners for Offering Business Insurance Benefits to Employees

Providing employee benefits is essential to attracting and retaining top talent in any business. Here are some of the key reasons why business owners need to give benefits to their employees:

- Attract and Retain Top Talent: Offering comprehensive employee benefits can help attract and retain top talent in your industry. By providing benefits such as health insurance, dental insurance, and retirement plans, you can show your employees that you value their health and long-term financial security. In addition, it can help create a positive work environment and foster employee loyalty and engagement.

- Improve Employee Satisfaction and Morale: Providing employee benefits can help improve their job satisfaction and morale. Employees who feel valued and supported by their employer are more likely to feel engaged and motivated. It can lead to higher productivity, better performance, and a more positive workplace culture.

- Increase Employee Productivity: When employees have access to benefits such as health insurance, they are more likely to take care of their health. As a result, it can lead to fewer sick days, reduced absenteeism, and increased productivity. Additionally, offering benefits such as retirement plans can help employees feel more financially secure and reduce financial stress, leading to increased productivity.

- Demonstrate Corporate Responsibility: Providing employee benefits can help demonstrate your company’s commitment to corporate responsibility and social responsibility. In addition, by showing that you value your employees’ health, well-being, and financial security, you can help build a positive reputation for your company and attract customers and investors who share your values.

Conclusion

In conclusion, it is crucial to take out business insurance to protect your business in the long run. Unfortunately, many types of business insurance are available for employees, and it can be overwhelming to know where to start. Thankfully, Brilliant insurance is here to help. With Brilliant Insurance, you can get the coverage you need without any hassle, as it is one of the best insurance agencies in the Dallas Fort Worth area.

So, take the time to explore your options and find the best business insurance coverage for your business today. With their comprehensive range of business insurance products, you can choose the right insurance for your business at a competitive price. In addition, with their expertise, your business will be well-protected and can focus on what matters most: growth and success.

Your article helped me a lot, is there any more related content? Thanks!